Hong Kong is a financial hub in Asia and home to one of the largest stock exchanges in the world, the Hong Kong Stock Exchange. In fact, last April Hong Kong surpassed Japan as the world’s third largest stock market and has been #1 in terms of total IPO funds raised in 5 of the past 8 years. In this article, we zoom in on the background of the exchange and the five top traded Hong Kong stocks this year.

History of the Hong Kong Stock Exchange

The Hong Kong Stock Exchange dates all the way back to 1891 when the first stock exchange called “The Association of Stockbrokers in Hong Kong” was formed. This name was later changed to The Hong Kong Stock Exchange.” However, it wasn’t until 2000 that the Hong Kong Stock Exchange, the Hong Kong Futures Exchange (HKFE), and the Hong Kong Securities Clearing Company (HKSCC) became wholly owned subsidiaries of Hong Kong Exchanges and Clearing (HKEX). This same year, HKEX became one of the first exchanges to go public, and currently still trades on the Hong Kong Stock Exchange. In 2012, HKEX acquired the London Metals Exchange, expanding trading opportunities to investors. As of December 2018, the Hong Kong Stock Exchange has 2,315 listed companies and a market capitalisation of $29.9 trillion.

Companies traded on Hong Kong Stock Exchange

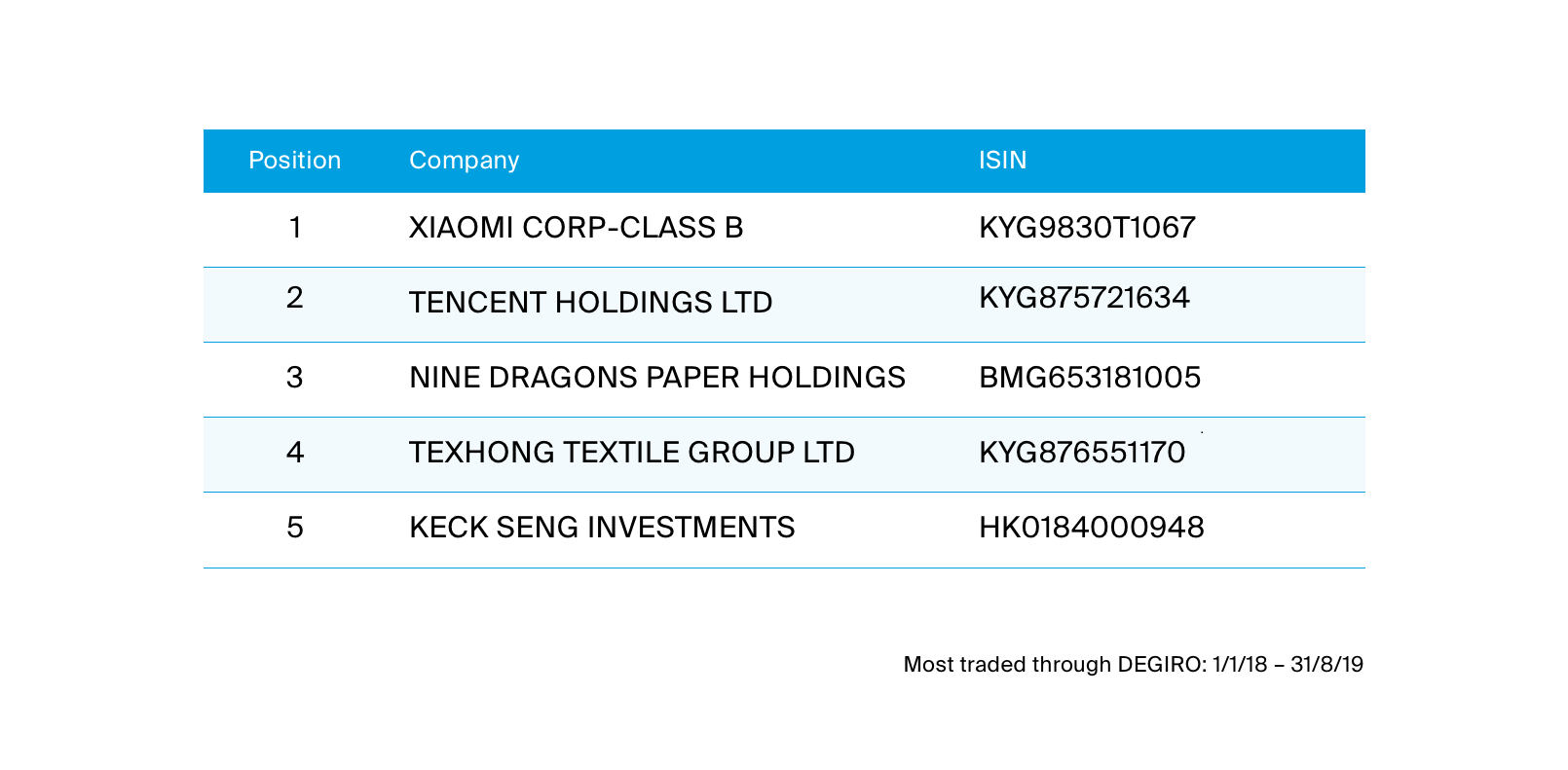

Alibaba has postponed its return to the Hong Kong Stock Exchange due to ongoing protests in Hong Kong. China's largest e-commerce company was expected to be listed again at the end of 2019, but decided to postpone it because of the political turbulence in Hong Kong. Even without Alibaba, the Hong Kong Stock Exchange still offers an abundance of choice as most major Chinese companies are listed on it. Asian giants such as Tencent Holdings, China Mobile, Xiaomi Corporation and ICBC can all be found on this exchange. Below you will find the five top-traded stocks on the Hong Kong Stock Exchange via our platform:

Xiaomi

The top traded Hong Kong stock on our platform is Xiaomi. Founded in 2010, Xiaomi is a Chinese internet company with smartphones and smart hardware connected by an Internet of Things (IoT) platform at its centre. In fact, the “MI” in the company’s logo stands for “Mobile Internet.” Although Xiaomi has only been around for 9 years, Xiaomi products are present in more than 80 countries and regions. Currently, Xiaomi is the world’s fourth largest smartphone brand in the world.

Xiaomi breaks its revenue down in four categories: Smartphones, IoT & Lifestyle Products, Internet Services, and Others. In Q2 2019, Xiaomi reported revenues of almost RMB52 billion (≈£5.9 billion)[1], a 14.8% increase from the same period in 2018. Xiaomi is trading around HK$9.04 (≈£0.94)[2] per share as of 24/10/19.

Tencent Holdings Ltd.

The second most traded stock on the Hong Kong Stock Exchange via our platform is Shenzhen-based Tencent. Tencent Holdings Limited is a Chinese holding company that has many subsidiaries that specialise in providing internet and mobile value-added services (VAT), e-commerce transactions, and online advertising. In their wide product portfolios are famous apps such as WeChat and Clash of Clans. Tencent is a part of the BAT stocks, a Chinese counterpart to FAANG (Facebook, Amazon, Apple, Netflix, and Google) in the US. BAT is an acronym for three large Chinese internet stocks: Baidu Inc., Alibaba Group Holding Ltd., and Tencent Holdings Ltd.

Tencent’s revenues totalled RMB174.3 billion (≈£20 billion) [1] for the first half of 2019, which is a 18% increase year over year. The company breaks their revenue income in the categories: VAS, FinTech & Business Services, Online Advertising and Others. In Q2, revenues increased for each category from the same quarter in 2018. Revenues from VAS increased by 14%, revenues from FinTech and Business Services increased by 37%, and revenues from Online Advertising increased by 16%. EBITDA was also up 24% in Q2 of 2019 in comparison to Q2 in 2018. As of 24/10/19, Tencent is trading around HK$319 (≈£33.23)[2].

Nine Dragons Paper Holdings

Nine Dragons is a paper manufacturing company that primarily produces linerboard, high performance corrugating medium, and coated duplex board. They also produce printing, writing, and specialty paper as well as pulp. The company has production bases in Dongguan, Taucang, Chongqing, Tianjin, Quanzhou, Shenyang, Leshan, Hebei, and Vietnam as well as pulp and paper mills in the United States. The company’s philosophy is “No Environmental Management, No Paper Making.” Nine Dragons Paper Holdings has said that they are committed to using recovered paper for their papermaking and ensure that their environmental and energy consumption indices are better than government standards.

Nine Dragon’s fiscal year ended 30/6/19. For the 2019 fiscal year (FY2019), Nine Dragon’s revenue increased to RMB3.86 billion (≈£442.12)[1], approximately 3.5% compared to FY2018. Nine Dragons is a dividend paying stock. At the end of FY2019, they reported a dividend payout ratio of 34.0%. Shares of Nine Dragons Paper Holdings were trading around HK$6.96 (≈£0.73)[2] as of 24/10/19.

Texhong Textile Group Ltd.

Texhong Textile Group Ltd. is an investment holding company that engages in the production and distribution of yarn, grey fabrics, garment fabrics, and fashion cotton textiles. Since the company was founded in 1997, Texhong Textile Group Ltd. has grown to become one of the largest core cotton textile suppliers in the world. The name Texhong was selected as Tex means textile and Hong is the surname of the founder, Mr. Tianzhu Hong.

Texhong revenue segments are yarn, garment fabrics and garments, and grey fabrics. In Texhong’s interim report for 2019, they reported an increase in revenue in all sectors aside from grey fabrics. In comparison to the first half of 2018, overall revenue increased by approximately 15.7%, totalling around RMB10.19 billion (≈£1.17 billion)[1]. Earnings per share decreased from the first half of 2019 year over year from RMB0.66 (≈£0.08)[1] to RMB0.51 (≈£0.06)[1]. Texhong has attributed this decrease to the trade friction between China and the United States. On 24/10/19 one share of Texhong was trading around HK$7.95 (≈£0.83)[2].

Keck Seng Investments

Keck Seng Investments is a holding company in which its primary business activities are in property and hotel businesses. The company operates through three segments: hotel, property, and an investment and corporate. Keck Seng Investments is present in Vietnam, Macau, the United States, China, Japan, Canada and other countries and regions around the globe. Some of the more notable hotels that they own are the W Hotel in San Francisco and the Sheraton Hotel and Towers in Saigon.

Keck Seng’s revenue for the first half of 2019 was HK$916.1 million (≈£95.3 million)[2]. This is a 7.1% decrease compared to the first half of 2018. In the company’s interim report, they said that this decrease is primarily due to a decline in hotel business. The W Hotel in San Francisco and the Sheraton Hotel and Towers in Saigon were under renovation in 2019, which the company attributes to the 7.9% decrease in revenue from hotel operations. On 24/10/19 Keck Seng was trading around HK$4.45 (≈£0.46)[2].

Why invest on the HKEX?

The HKEX is the second largest exchange in Asia after the Japan Exchange Group, and the fifth in the world in terms of market capitalisation. The exchange is dominated by many large-cap Chinese companies, commonly known as H-shares. Counterparties such as the Shanghai and Shenzhen Stock Exchanges used to only be accessible for the local population. That is why most major Chinese public companies are listed on the HKEX. If you would like to invest in China, HKEX is therefore your go-to exchange.

Another reason to invest in HKEX could be to diversify your portfolio. Investing is not without risk, but it is important to diversify to reduce risk. Imagine your whole portfolio would consist of products in one country. If that country suffers from a national recession, your entire investment portfolio will take a substantial loss. But with a well-diversified portfolio, the losses from one position can be made up for by the gains in another. This is the main benefit of diversification: the decrease of risk. DEGIRO offers trading on more than 50 exchanges across 30 different countries, making it easy to diversify your portfolio.

How to invest on the Hong Kong Stock Exchange?

As you may know, acquiring shares that trade on the Hong Kong stock market is not easy, as only a few European brokers offer access to this exchange. DEGIRO enables you to have a true global investing experience, offering trading on the Hong Kong Stock Exchange for the low fee of €10.00 + 0.068% per order. At this time, we do not offer live price information for the Hong Kong Stock Exchange and only the end of day prices are displayed. However, more price information for stocks can easily be found online. Although live price information is not available, you are still able to place your orders through DEGIRO.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Please be aware that facts may have changed since the article was originally written. Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products which match your knowledge and experience.

Sources: Xiaomi, Tencent, Nine Dragons Paper Holdings Limited, Texhong, Keck Send, Yahoo Finance, Bloomberg, Reuters

Exchange rates as of 10/10/19:

1 1 RMB =0.114665 GBP

2 1 HKD =0.104182 GBP