Considering environmental, social and governance (ESG) criteria in the investment decision-making process has gained traction in recent years. Some research suggests that companies with high ESG scores perform better and carry less risk, which is particularly relevant during these turbulent and unprecedented times.

However, before getting too far into this topic, we first provide some background information about what ESG is. Followed by that, we discuss the growth in this investment strategy, its performance and ways that you can implement it.

What is ESG?

ESG is an investment strategy that takes into account environmental, social and governance factors alongside financial factors when making investment decisions. It falls under the ‘sustainable investing’ umbrella. The term ESG was coined and popularised in 2005 after a report was published by the UN Global Compact with recommendations on how to integrate ESG issues into capital markets. Since then, ESG has become common financial jargon and is becoming more mainstream when it comes to investment strategies. Below is a breakdown of factors relating to a company’s impact on the environment and society and the way a company is governed:

- Environmental (E): climate change, greenhouse gas emissions, recycling practices, water usage, usage of renewable energy, raw material sourcing, etc.

- Social (S): employee health and safety, fair wages, employee training and development, ethical supply chain sourcing, privacy and data security, etc.

- Governance (G): board diversity, executive pay, business ethics, transparency, political contributions, etc.

Rating agencies will evaluate companies’ ESG practices and give them a score. Methodologies and scoring can differ depending on the agency. The world’s largest index provider, MSCI, for example, has a rating system where it rates companies on a ‘AAA to CCC’ scale and based on a company’s rating, it is classified as ‘laggard’, ‘average’ or ‘leader’.

Growth in ESG investing

Integrating ESG into investment strategies has grown with momentum. MSCI, cited three main reasons for ESG investment growth:

- New challenges: Issues such as rising sea levels and personal data leaks, for example, are more prevalent in today’s day in age and introduce new risks to investors. Therefore, an investor may evaluate investment strategies according to these new risks.

- New investors: There is a new generation of investors that do not only consider the bottom line in their investments. Interest is growing in strategies that follow ESG standards.

- Availability of data and analytics: There is more research and data from companies regarding ESG available, which investors can use in making their decisions.

In 2019, UBS published research that covered more than 600 asset owners across 46 countries that collectively were responsible for over €19 trillion in assets. Out of these, one third were already signatories to the United Nations Principles for Responsible Investment charter, a set of six principles that are a global standard for responsible investing. Out of the remaining two thirds, 68% reported that they are applying ESG standards and 25% indicated that they plan to.

Some leading investment management companies are even centering their investment strategies around ESG. For example, BlackRock, the world’s largest asset manager, announced in January 2020 that it would be shifting its strategy towards investments related to climate change issues.

In addition to growth in ESG integration in investment strategies, it is also becoming more relevant when it comes to credit ratings. Moody’s, one of the Big Three credit rating agencies, said in April 2020 that ESG considerations will be of growing importance in assessments of issuer credit quality.

ESG investing and performance

Whether companies with higher ESG scores perform better or not has been long debated. While some argue that incorporating ESG practices can hurt overall performance and negatively impact bottom lines, there is a growing amount of research that suggests that that is not the case.

For example, a study conducted by MSCI in 2017 found that companies with higher ESG ratings were associated with higher profitability, lower tail risk and lower systematic risk. In 2019, the International Monetary Fund (IMF) published a report that suggested that when investors make investment portfolios that prioritise ESG values, returns are not necessarily sacrificed. However, the report did not indicate that sustainable investors outperform regular investors.

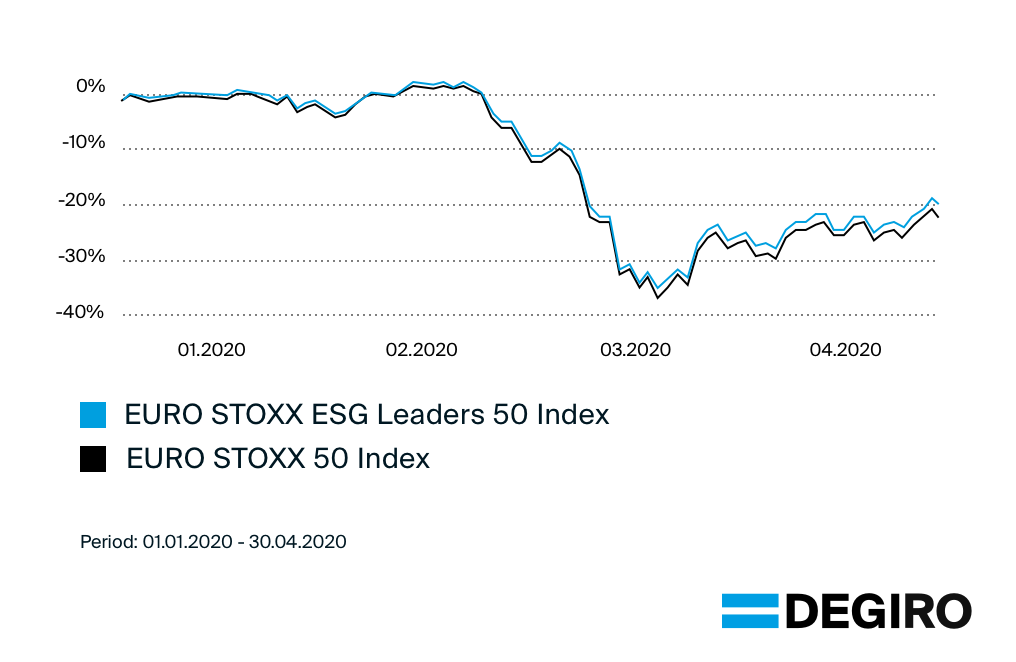

More recently, the European Securities and Markets Authority (ESMA) published a report on trends, risks and vulnerability in February 2020, which touched upon the subject. The report disclosed that sustainability considerations in investment strategies and decisions have accelerated in the past few years. It also looked at the performance of the EURO STOXX ESG Leaders 50 index with its corresponding benchmark index, the EURO STOXX 50. In a two-year timeframe from 2017 to 2019, the EURO STOXX ESG Leaders 50 outperformed. However, ESMA also cited that the lack of standardisation in ESG data and reporting can lead to uncertainty in measuring ESG impacts, greenwashing and reputational risks.

If we take a look at the performance of the two indices from the beginning of the year, we see that the two were closely matched in January and February 2020. The gap between the two began to widen around March 2020 whereby the EURO STOXX ESG Leaders 50 index was outperforming its counterpart.

In March 2020, Bloomberg reported that 59% of US ESG ETFs outperformed the S&P 500 index and 60% of European ESG ETFs beat the MSCI Europe Index in the first quarter. However, it was also noted that six of the ten largest ESG-focused US mutual funds performed worse than the S&P 500 during the same timeframe. Therefore, it is important to note that ESG investments are not outperforming across the board. Additionally, past performance does not guarantee future results.

Implementing an ESG strategy

If implementing an ESG strategy to your portfolio is something that you are interested in doing, there are many ways of going about it. In terms of individual stocks, it is relatively easy to find information regarding a company’s ESG involvement and scores online.

There are also a growing number of investment funds and ETFs that only include companies that meet certain ESG standards. You can find information about the composition of a fund on the issuer’s website.

DEGIRO offers a number of ESG investment funds and ETFs on our platform. We also have access to over fifty exchanges across thirty countries, making it possible for you to achieve a well-diversified portfolio for low fees.

The information in this article is not written for advisory purposes, nor does it intend to recommend any investments. Please be aware that facts may have changed since the article was originally written. Investing involves risks. You can lose (a part of) your deposit. We advise you to only invest in financial products that match your knowledge and experience.

Sources: Bloomberg, Reuters, UBS, MSCI, Motley Fool, Investopedia, BlackRock, ESMA, IMF, Morgan Stanley