A strong partnership

DEGIRO has always strived to provide added value by developing affordable, custom-made financial services for all investors. This new chapter with flatex will allow us to continue doing so and improve our services to you.

DEGIRO has always strived to provide added value by developing affordable, custom-made financial services for all investors. This new chapter with flatex will allow us to continue doing so and improve our services to you.

Joining forces

Per August 1st 2020, DEGIRO is a proud member of flatex group and together form one of the biggest pan-European brokers. DEGIRO and flatex complement each other well, resulting in many synergies. flatex brings a lot of experience in the brokerage industry and operates under a German banking license. This offers further stability and an increased capacity for sustainable growth and development as an organisation.

Benefits for you as our client

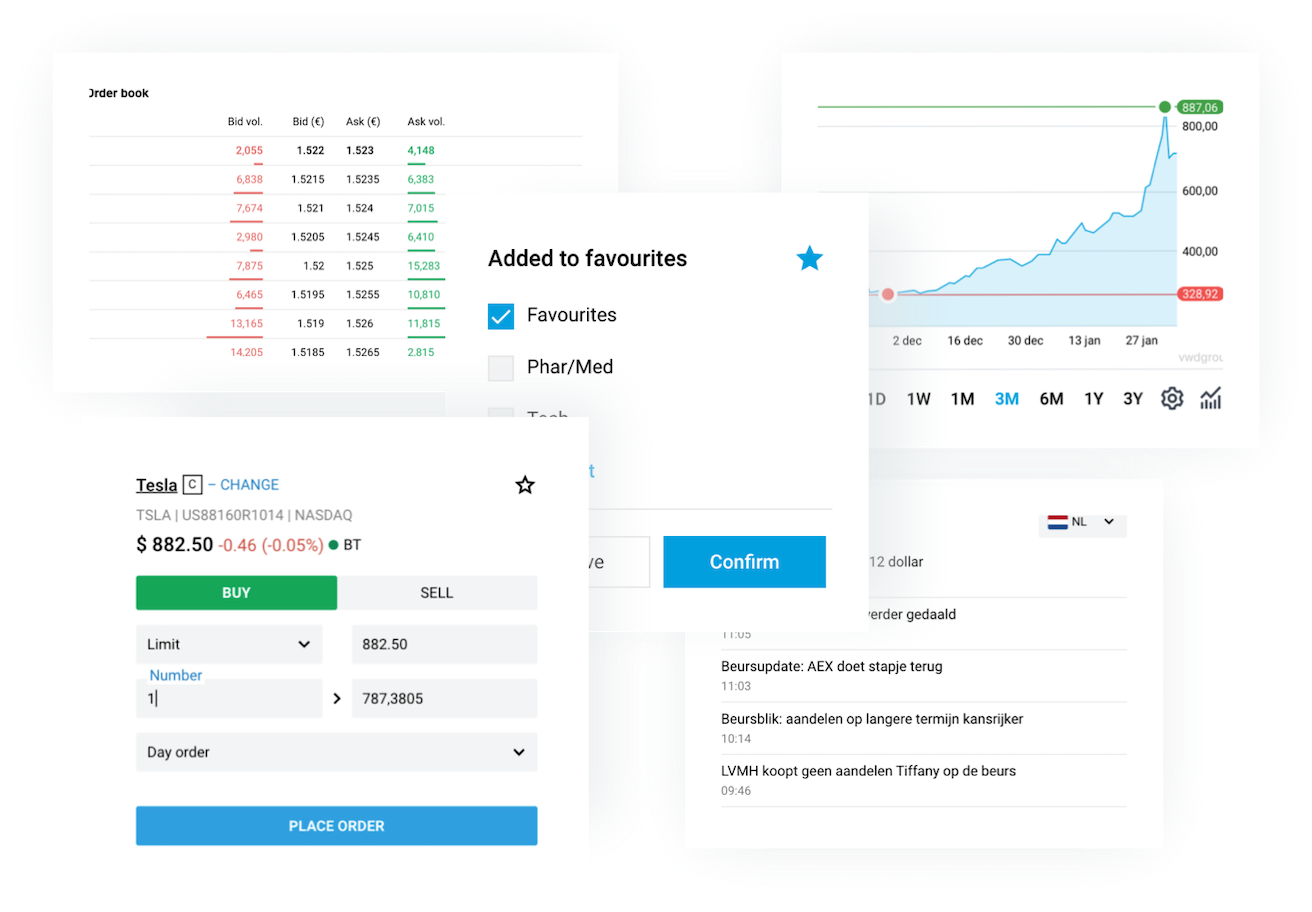

The highly complementary structures of DEGIRO and flatex create new opportunities that will help take our trading platform and services to the next level.

Same awarded trading platform

You can continue using our familiar award-winning trading platform and may expect the same level of service from our Service Desk. The DEGIRO brand will remain as is.

Bank solution for uninvested money

During the second half of 2020, we will make flatex bank accounts available for our clients to hold their uninvested money. This will replace the current Money Market Fund setup. Your money will then fall under the German €100,000 Deposit Guarantee Scheme.

More to come

The partnership may lead to an even wider range of product offerings for you as a client. On top of that, we are investigating the possibility of extending trading hours.

About flatex

Founded in 2005, flatex Bank is a full-service bank based in Germany. It is thus subject to supervision by the BaFin (Federal Financial Supervisory Authority) and is allocated to the Compensation Scheme of German Banks (Entschädigungseinrichtung deutscher Banken). With one of the most efficient securities settlement systems in Europe, flatex Bank is one of the leading providers of financial technology and executed 13.1 million transactions for its customers in the first half of 2020.